April 09, 2024

The Inflation Reduction Act of 2022 (IRA) created a significant financial buzz when it was signed into law, allotting approximately $79.4 billion in supplemental funding to the Internal Revenue Service (IRS)—a number which was later adjusted to about $78 billion post a subsequent rescission by Congress. This substantial funding, earmarked to be utilized through September 30, 2031, symbolizes a significant move in both the transformation efforts of the IRS and the future of tax administration.

These lines will analyze a report by the Treasury Inspector General for Tax Administration (TIGTA) that provides cumulative and quarterly reporting on the IRS’s use of IRA funding to implement its Strategic Operating Plan. The report includes all IRA expenditures through December 31, 2023.

How Is the Funding Allocated?

During fiscal year development and amid ongoing governmental negotiations, such as continuing resolutions that maintain funding at the previous fiscal year’s (FY) levels, the IRS operates with annual appropriations and other financial resources. For FY 2023, the IRS’s annual appropriation was set at $12.3 billion, excluding funds for the IRS’s Business Systems Modernization, which is imperative for upgrading information technology systems.

However, the pressure on the IRS’s operational purse strings has been eased thanks to the IRA. This funding boost serves as a foundation for enhancing the IRS’s capabilities, specifically aimed at achieving five key transformation objectives outlined in the IRS’s Strategic Operating Plan (SOP). These objectives target improved taxpayer services, updates to IRS computer systems, and ramped-up compliance and enforcement efforts against high-income individuals and large corporations—a move indicative of a more agile and user-centric IRS in the forecast.

Spending Today for a Better Tomorrow

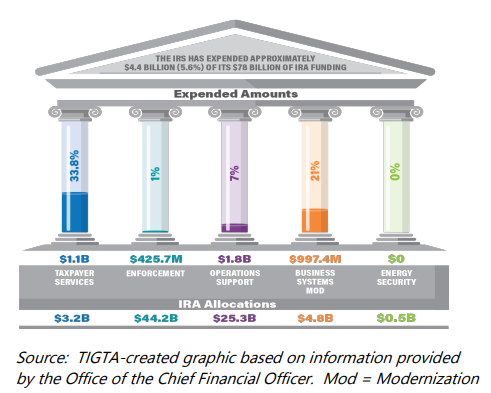

As tax professionals and financial analysts monitor the trajectory of these taxpayer dollars, it becomes clear that the IRS is treading thoughtfully, albeit slowly, on this fiscal path. By the close of December 31, 2023, the IRS reported expending approximately $4.4 billion—just 5.6 percent of the available IRA funds. The use of nearly half of these funds to cover routine operating costs — due to the inadequate annual appropriations — highlights the financial duress the IRS had been facing before the IRA’s timely intervention.

Significantly, the report from the TIGTA gives a quarterly snapshot, shedding light on the IRA expenditures dedicated toward various initiatives within the SOP. For instance, around $863 million of the IRA funding was used in just the first quarter of FY 2024. In the otherwise constrained budget situation, the IRA funding also made continued focus on the direct e-file tax return system possible, ensuring that modern-day taxpayer needs are met more efficiently.

Cumulative IRA Expenditures by Funding Activity Through December 31, 2023

Transparency and Transformation

The tax world is no stranger to scrutiny, and the IRS’s handling of the IRA funds is a testament to the demand for transparency in government spending. Congress’s interest in overseeing the effective allocation of these substantial resources is matched by the broader community of financial stewards, who demand accountability.

Given the broad timespan of the IRA fund availability, continual reporting by TIGTA promises further insights into how the IRS approaches its comprehensive transformation. The detailed reporting reveals a complex financial landscape where legacy systems will gradually make way for modernized processes, enhanced taxpayer service becomes a reality rather than a goal, and compliance is steadfastly monitored.

Final Thoughts

For tax professionals and financial analysts alike, the unfolding story of the IRA funds is not merely about the dollars being spent. It’s about envisioning an IRS better equipped for the future—where taxpayer services are vastly improved, technology is seamlessly integrated, and fair enforcement is not just aspired to but achieved. These quarterly reports become valuable indicators to measure progress toward these lofty goals as we examine them. Time will tell whether these promising seeds of change will fully blossom into the solid infrastructure that taxpayers and the Administration desire. In any case, our team at ECG Tax Pros will always stay up to date to provide clients with the best service and help thousands of individuals and small businesses navigate smoothly through their tax payments. Let us help you, too!